What We Do

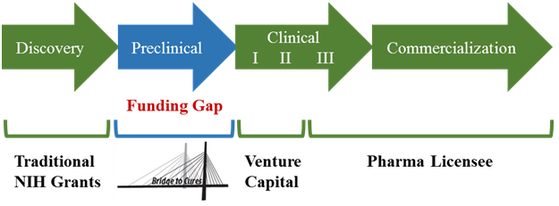

B2C engagement may include support for proof of concept leading to a clinical prototype or other clinical validation. In the case of drug development this often means funding through preclinical testing or initial human trials.

|

Our Investment Focus

A particular interest is addressing unmet medical needs and pursuing rare disease interventions. Rare diseases are an area of significant unmet needs and have compelling product development and partnering advantages. Currently there are 7,000 rare disease awaiting new treatments. Our goal is to maximize both commercial viability and social impact by advancing important health care ideas into products, such as rare diseases. Furthermore, therapeutic advances for rare diseases can have impact in other disease areas. Each year funding will be awarded at our highly publicized annual event, the Healthcare Innovator Pitch (HIP). The HIP event provides entrepreneurs the opportunity to pitch to a panel of experienced life science venture capitalists from across the country. The event will be hosted at the UWM Innovation Campus (Innovation/Accelerator Building). |

|

Mentoring

During the HIP screening and mentoring process selected applicants will participate in a Lean Startup boot camp (co-hosted with UW-Milwaukee; and modeled after the National Science Foundation’s highly regarded i-Corp program) where they can refine their pitch and business concept. They will also receive mentoring from our Advisory Board, which is a panel of business and scientific experts that provide strategic advice on proposals & operational matters. Our Seed and Growth Committee, which includes 2 leading Wisconsin life science venture capitalists and 6 venture capitalists from across the U.S. and Europe, will also be available for coaching selected applicants. We will provide business (e.g. accounting; market analysis) and legal (e.g. intellectual property) guidance for applicants. |

|

Making B2C Evergreen

B2C will structure new venture financings to provide a reasonable return on investment, while not jeopardizing future angle or venture rounds. As such, we expect portfolio companies to cash out our investments when they are subsequently funded in a VC round and/or when the spinout is revenue generating. Investment funds returned to B2C (which is structured as a nonprofit C-corporation) will allow us to make future investments. |

|

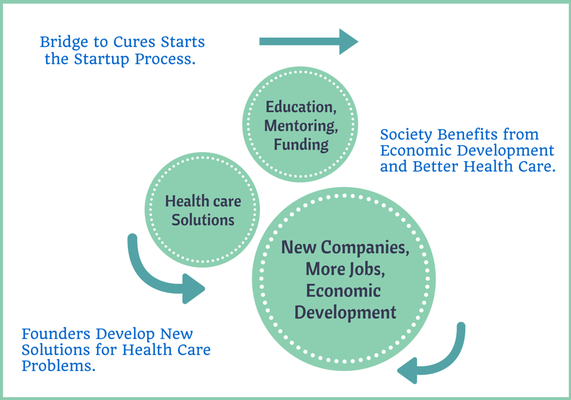

Economic Development

B2C works in partnership with the Wisconsin Economic Development Corporation (WEDC), which has provided investment funds. We have also partnered with six southeast Wisconsin research institutions, through the Clinical and Translational Sciences Institute, leveraging over $150 million in annual healthcare research grants, to turn their research into products and startup companies. Through our Advisory Board and Seed and Growth Committee we are able to provide mentoring and education to health care entrepreneurs. The companies they build will improve the health of society and generate economic growth. |